Irs Capital Gains 2025. For the 2025 tax year, the highest possible rate is 20%. See how your investments will grow over time.

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). Income phaseouts for education benefits.

Irs 2025 Tax Brackets Emyle Isidora, The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one. If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if.

Cuddy Financial Services's Tax Planning Guide 2025 Tax Planning Guide, But it’s possible you will owe taxes on your home. The internal revenue service since 2014 has viewed crypto as property, so profits made from selling tokens are subject to capital gains taxes.

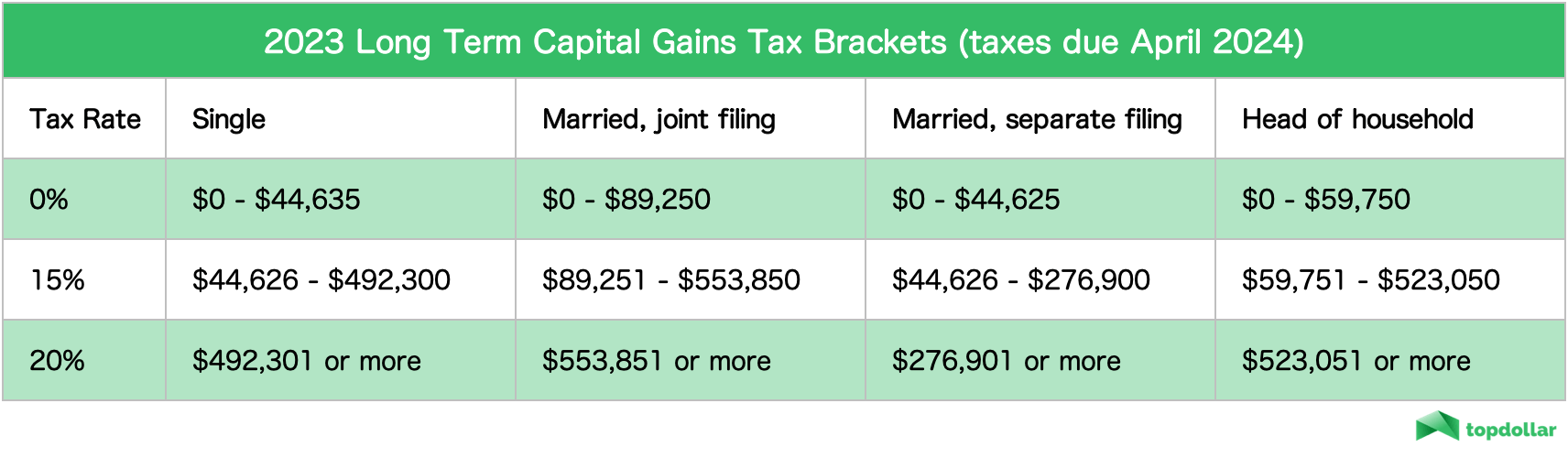

20222023 Tax Rates & Federal Tax Brackets Top Dollar, The irs may adjust the capital gains tax rate each year. Understanding how to report capital gains and losses on your tax forms is crucial for anyone dealing with investments or asset sales.

California Individual Tax Rates Tables 2025 22, 2) how long you held the investments. Capital gains taxes on assets held for a year or less are taxed according to.

Short Term And Long Term Capital Gains Tax Rates By Free, That’s up from $44,625 this year. For single taxpayers with income from $200,000 to $250,000, would lower the rate to 5%, from 5.5%;

今天七一,浅学一篇应景的汉俄翻译 哔哩哔哩, Irs may owe you from 2025. • 4mo • 2 min read.

20++ Qualified Dividends And Capital Gains Worksheet 2019 Worksheets, Here's how those break out by filing status:. For the 2025 tax year, the highest possible rate is 20%.

How to Calculate Capital Gains Tax on Real Estate Investment Property, That’s up from $44,625 this year. Should you rent or buy?

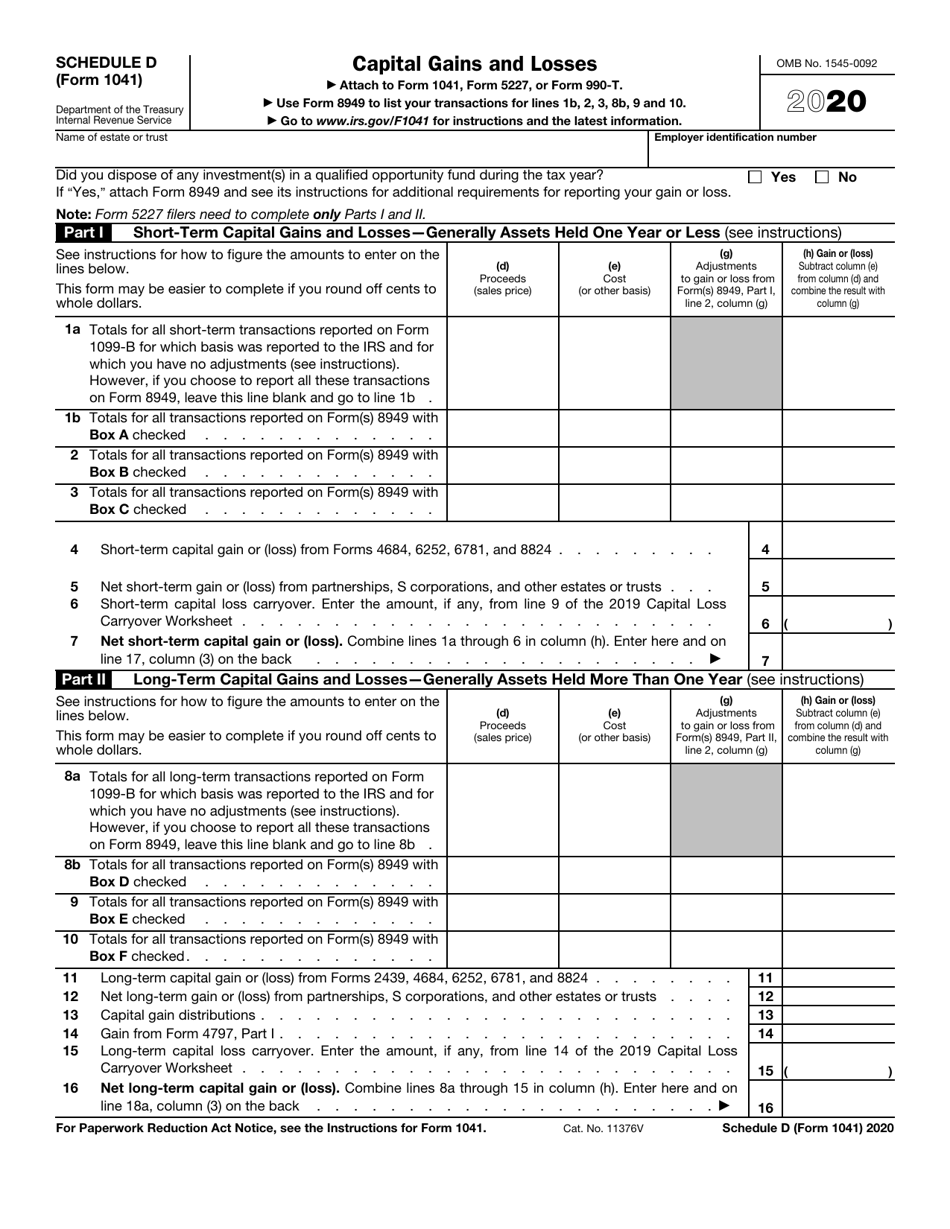

Schedule D Form 1041 Fillable Printable Forms Free Online, Here's how those break out by filing status:. Here's how much you can make to pay 0% capital gains taxes on investments.

2025 Tax Brackets Irs Calculator " Unblocked 2025, How much you owe depends on your annual taxable income. You’ll pay a tax rate of 0%, 15% or 20% on gains from the sale of most assets or investments held for more than one year.